|

AGCoinHunter

Penny Hoarding Member

USA

685 Posts |

Posted - 05/27/2010 : 08:32:29 Posted - 05/27/2010 : 08:32:29

|

Charts are at the link...

Link: You must be logged in to see this link.

Silver remains the preserve of relatively few contrarian investors. The media and financial press rarely covers it, and yet it is in the intermediate stage of a bull market that may rival that of the 1970s.

The primary reason for this is the continuing and increasing global macroeconomic, currency and geopolitical risks; silver’s historic role as money and a store of value; its declining and very small supply; significant industrial demand and - perhaps most importantly - significant and increasing investment demand.

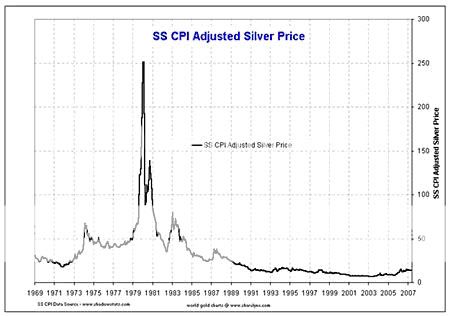

Silver rose from under $1.50/oz in 1970 to nearly $50/oz in 1980 - more than 25 times. The average price of silver in 2001 was $4.37/oz. A 25-fold increase on that would take it to over $110/oz. While this may seem outlandish to some, it is worth remembering that silver’s record high in 1980 adjusted for inflation was some $130/oz.

Admittedly, the final phase of the silver blow off was a speculative bubble as the billionaire Hunt brothers attempted to corner the silver market. Unlike in 1979, today there are hundreds of billionaires, some multi billionaires, thousands of millionaires, hedge funds and many sovereign wealth funds. Small allocations by any of these will see sharp moves up in the price. Indeed, the silver market is small and could very easily be cornered again.

Declining supply

It is estimated more than 90% of all the silver that has ever been mined has been consumed by the global photography, technology, medical, defence and electronic industries. In 1900 there were 12 billion ounces of silver in the world. By 1990, that figure had been reduced to around 2.2 billion ounces, according to commodities-research firm CPM Group. And today, there are less than 1 billion ounces in above-ground refined silver.

And that is projected to shrink even more. Industrial demand has been outstripping mining supply for most of the last 20 years. It hasn't resulted in significantly higher prices yet because the world has been able to fill the gap from inventories and official government stockpiles.

However, today the US government's stockpile is all but gone, and sales from sources such as China, Russia and India are declining, too. Silver stocks are near an all time low. Very importantly, silver is very unusual as its supply is inelastic.

Silver production is unlikely to ramp up significantly if the silver price goes up. Silver is a byproduct metal - some 80% of mined silver is a byproduct of base metals such as copper, nickel, zinc and lead. Higher prices for silver will not cause other base metal miners to increase their production. In the event of a global stagflationary or deflationary slowdown, demand for base metals would likely fall, thus further decreasing the supply of mined silver. There are only a handful of pure silver mines remaining – many with depleting reserves - so one should not expect significant mine supply to depress the price if silver shoots up.

Increasing demand

Industrial applications for silver have always been significant, but have increased in recent years. Add to that growing middle classes in emerging economies demanding the quality of life and standard of living enjoyed by many in the West. Plus, it has many and increasing medical applications and is being increasingly tapped for its biocidal properties.

And it is important to note that because of gold's much higher value, it gets recycled - all the gold mined in the world ever is still with us. But the current price of silver makes recovery and recycling uneconomic.

Investment demand for silver has risen in recent years too as investors concerned about the value and safety of property, equities and deposits allocated funds to the finite commodities that are silver and gold. More recently, there are increasing concerns about the value of paper currencies themselves which is leading to further diversification into hard assets and precious metals.

Silver is undervalued versus gold, with the gold silver ratio at 65:1 ($1,200oz/$18.5/oz) This is particularly the case in the long term. The long term historical average gold to silver ratio, going back to even before ancient Greece and Rome, is 15:1. This is because it is estimated that geologically there are some 15 parts of silver in the ground for every 1 part of gold. In 1980 the ratio nearly reached 15 ($850oz/$50oz=17). The average in the 20th century has been around 40:1.

Many analysts believe that silver’s ratio to gold will revert to its mean average in recent years below 40:1.

A picture or a chart truly is worth a thousand words and the chart above showing silver prices adjusted for inflation shows how seriously undervalued silver remains.

|

"All tyranny needs to gain a foothold is for people of good conscience to remain silent."

-Thomas Jefferson

"There is no difference between communism and socialism, except in the means of achieving the same ultimate end: communism proposes to enslave men by force, socialism—by vote. It is merely the difference between murder and suicide." - Ayn Rand

________________________________________________

Lenin: Class-based International Socialism

Hitler: Race-based National Socialism

Obama: Class- and Race-based Post-National Socialism

|

Edited by - AGCoinHunter on 05/27/2010 08:37:15 |

|